No CrossRef data available.

Article contents

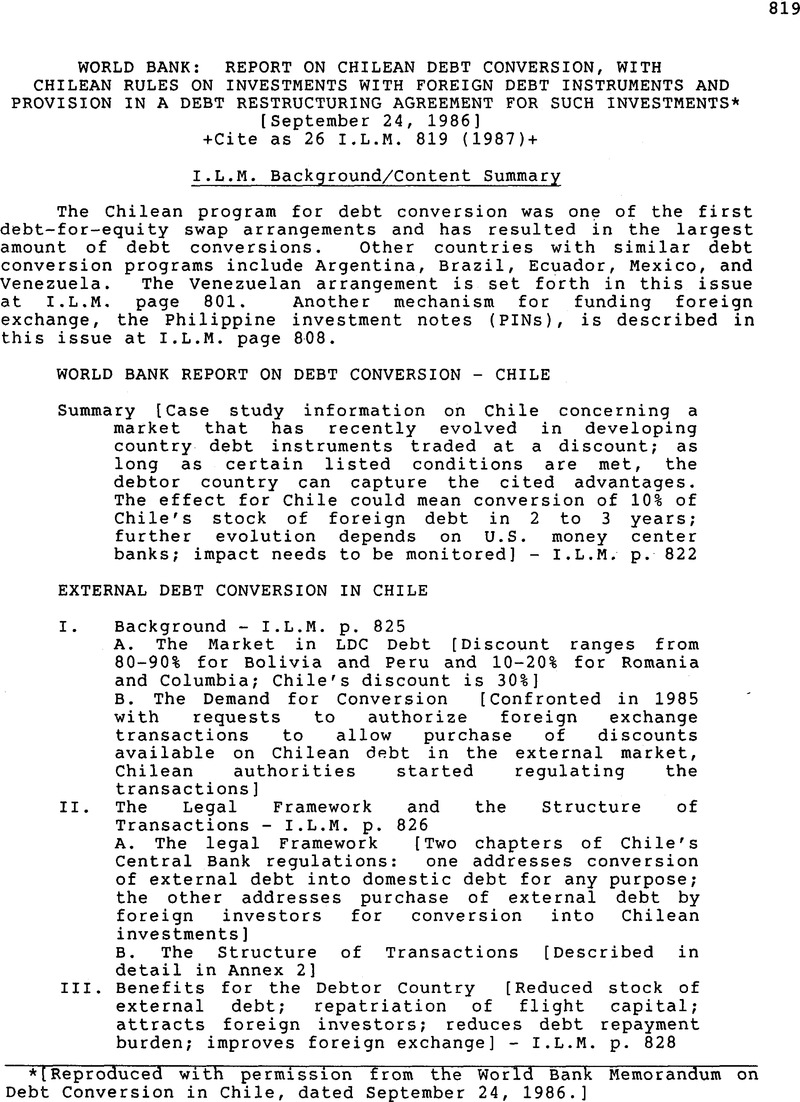

World Bank: Report on Chilean Debt Conversion, with Chilean Rules on Investments with Foreign Debt Instruments and Provision in a Debt Restructuring Agreement for Such Investments

Published online by Cambridge University Press: 27 February 2017

Abstract

- Type

- Reports

- Information

- Copyright

- Copyright © American Society of International Law 1987

Footnotes

[Reproduced with permission from the World Bank Memorandum on Debt Conversion in Chile, dated September 24, 1986.]

References

1/ In this summary and in the attached report, the term “debt conversion” is used rather than “debt equity” conversion. This is because debt conversion can take place for foreign direct investment purposes or for more general purposes by resident.

1/ These rules of the game" include how the benefits are to be shared among the partie.

1/ There are no estimates of size available. However, one large bank has mentioned that a figure of $1 billion a month trading volume may have been reache.

2 Such sales might be held to establish a “market value” below par and cause the banks, for accounting reasons, to “mark to market” the balance of their holdings. They may also be concerned about the effect on the discount if they were to become significant suppliers. On the other hand,there is also a cost in immobilizing part of their portfolio.Moreover, the stock market has already discounted the value of this part of their assets.This attitude may therefore chang.

1/ The provisions of each Chapter are described in Annex 1 (attached), the legal framework governing foreign investment in Chile is given in an earlier law DL 600. The relationship between Chapter XIX and DL 600 is also described in Annex.

1/ Chile's original foreign investment statute (DL 600) permits debt equity conversions but only in respect of the debtor's own capital. Chapter XIX does not contain this limitatio.

* [See 17 I.L.M. 134 (1978) for the text as amended to March 18, 1977.

1/ Banco Central has come under some criticism for "profiting" from this system. The system is widely known in Chile, with featured articles in the newspaper on the volume of bids offered, the volume accepted under the quota, the range of "cupos" offered, and the lowest accepte.

2/ If Debt included in the 1983 and 1984 restructuring agreements was excluded (see Annex 1.

* [An “a” acceptance; following the date “AA” means approval; A” means signifies accession, 's” means definitive signature.