Article contents

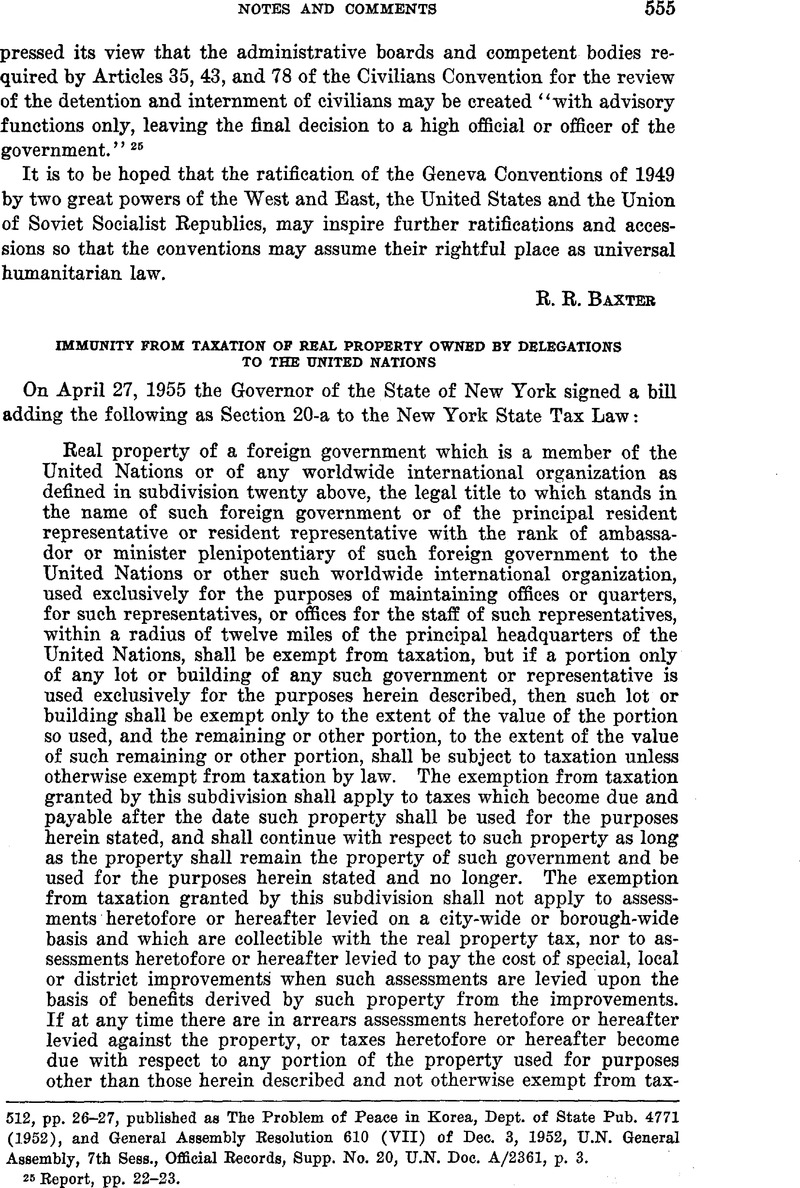

Immunity from Taxation of Real Property Owned by Delegations to the United Nations

Published online by Cambridge University Press: 30 March 2017

Abstract

- Type

- Notes and Comments

- Information

- Copyright

- Copyright © American Society of International Law 1955

References

1 Agreement of June 26, 1947, between the United Nations and the United States of America regarding the Headquarters of the United Nations, T.I.A.S. No. 1676; 43 A.J.I.L. Supp. 8 (1949).

2 4 Hackworth, Digest of International Law 579; letter by Secretary of State Bayard, 4 Moore, Digest 670.

3 Ever since embassy and legation buildings have been exempt from taxation in Washington, D. C, the exemption has applied to the residence of the ambassador or minister. See, e.g., the letter of Secretary of State Seward to Mr. Wallach of July 5, 1867, 4 Moore, Digest of International Law 669. See also Reference re Power of Municipalities to Levy Rates on Foreign Legations, [1943] 2 D.L.B. 481, where the Supreme Court of Canada said: “One of the diplomatic immunities recognized by English Law, as already intimated, is the inviolability of the Ambassador’s residence, that is to say, of the legation.”

4 For a discussion of this question, which is of great theoretical interest, see Bishop, “Immunity from Taxation of Foreign State-Owned Property,” 46 A.J.I.L. 239 (1952)Google Scholar; Lyons, “Immunities Other Than Jurisdictional of the Property of Diplomatic Envoys,” 30 Brit. Yr. Bk. Int. Law 116, 138, et seq. (1953)Google Scholar.

4a See District of Columbia Code, Title 47, secs. 801–a (c), 803.

5 Sixth International Conference of American States, Final Act (Havana, 1928), pp. 142, 150; Appendix 7 to Harvard Research in International Law, Diplomatic Privileges and Immunities, 26 A.J.I.L. Supp. 175, 176 (1932).

6 Idem 168, 170.

7 Idem 115.

8 Letter to Mr. Bayard, Ambassador to England, of May 29, 1893, 4 Moore, Digest of International Law 671, 672.

9 1 International Law 717 (7th ed., 1948).

10 Principles of International Law 294 (7th ed., 1927).

11 Juridical Bases of Diplomatic Immunity 137 (1936).

12 New York Law Journal, Dec. 30, 1925, p. 1279 (Sup. Ct. N. Y. Co.).

13 [1943] 2 D.L.R. 481, at 499.

14 4 Rechtsprechung zum Wiedergutmachungsrecht 368 (1953); translation, 48 A.J.I.L. 161 (1954).

15 H.Rep. No. 1093, 80th Cong., 1st Sess. 11, 12.

16 U.S. v. Pink, 315 U.S. 203, 230, 231 (1942); U.S. v. Belmont, 301 U.S. 324 (1937); Opinion of the Acting Atty. General of the U.S. of Aug. 20, 1946, 40 Op. Atty. Gen. 469; Opinion of the Atty. General of the State of New York, 1946, Op. Atty. Gen. N.Y. 75, 76; Corwin, Constitution of the United States of America 437 ff. (1953).

17 Bishop, loc. cit. supra, note 4, makes a strong case for exemption of real property owned by foreign governments and used for consular purposes. See especially pp. 248, 253, 256.

- 2

- Cited by